Which Sectors or Industries are Expected to Boom After 4th June 2024?

Following the announcement of the election results, the newly elected government will begin implementing its policies. However, given India's current economic performance, significant growth is anticipated in these sectors after June 4th.

Power Sector

Two months ago, the Ministry of Power released the draft National Electricity Plan, proposing a ₹4.75 lakh crore investment till 2027 to upgrade India's transmission system. India aims to boost its installed capacity to 900 GW by 2032, up from 426 GW currently.

Infrastructure

If the BJP is re-elected, the momentum in infrastructure development and capital expenditure is anticipated to persist. Ambitious initiatives such as bullet trains, expanded highway networks connecting more cities, and new waterways projects may be announced.

Real Estate

The housing market in India is booming due to high demand and supportive government policies, including increased capital expenditure. Housing inventories are at a 12-year low, with demand outpacing supply. In 2023, housing volumes surged by 25%, nearly doubling over three years.

Tourism

India’s hospitality sector is set to grow in the next 3-5 years. The average daily rate (ADR) per room is now ₹6900, higher than pre-COVID levels. The rate of occupancy has improved to 66%, up from earlier levels. Revenue per Available Room (RevPAR) has increased to ₹4540.

Electronics System Design & Manufacturing (ESDM)

The Indian ESDM market is expected to grow by 34%, reaching $110 billion in five years. To manage the current account deficit (CAD) affected by imports, the government is offering major incentives and a ₹76,000 crore PLI & DLI grant for the sector.

How Do Investors Decide What to Buy and What to Sell?

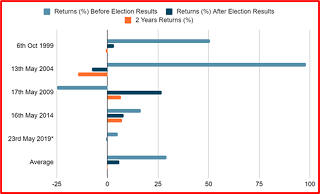

Many often wonder how to navigate the stock market during election cycles. While elections can introduce uncertainty, there are some strategies that seasoned investors consider.

Political Stability: Investors often favour parties or leaders who are perceived to be supportive of stable economic policies. They may buy stocks of companies that are expected to benefit from continuity in governance and policies.

Policy Expectations: Investors analyse the manifestos and statements of political parties to gauge potential changes in economic policies. They may buy or sell stocks based on expectations of policy shifts in sectors such as defence, infrastructure, tourism, FMCG and automobiles.

Foreign Investment: Investors also consider the impact of elections on foreign investment sentiment. Political stability and favourable policies can attract foreign investors, leading to buying activity in certain sectors or stocks.

Long-Term Outlook: Some investors focus on the long-term outlook rather than short-term election-related fluctuations. They may stick to fundamentally strong companies or sectors regardless of election outcomes.

In Conclusion

Looking ahead to the calendar year 2024, it seems India's economy will keep growing, even if there are some hurdles. Election years usually mean good news for markets, but it's best to keep it safe and cautious. Small companies might bring bigger rewards, but bigger ones could be steadier investments. Grabbing opportunities when markets dip is a smart move. Just keep your long-term goals intact and be flexible with your investment approach.

Disclaimer: Investments in the securities market are subject to market risk, read all related documents carefully before investing.

This content is for educational purposes only. Securities quoted are exemplary and not recommendatory.

For All Disclaimers Click Here: https://bit.ly/3Tcsfuc