Finance is a vast understanding and involvement in all the sectors. To make informed decisions and correctly predict the upcoming trends, it is essential to take into account various elements, tools, and methods. One among these is the correlation coefficient.

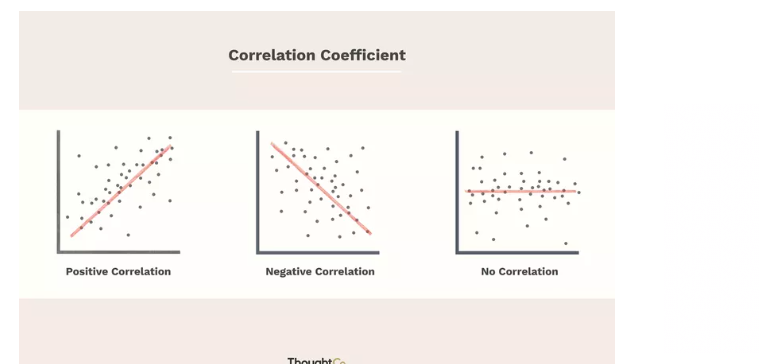

The correlation coefficient uses scatter plots (a type of graph) to represent the relation between two variables. These can be two continuous or independent variables. On a scale of -1 to +1, the results are presented. The correlation between two variables can be presented in the following ways:

Perfect positive relation

A perfect positive correlation is denoted by +1. When two variables move in the same direction, they share a perfect positive relation. If the one variable increases/decreases, the other one also shows the same properties.

Perfect negative relation

A perfect negative relation is the one denoted by -1. It is a situation where two variables are inversely related. They share a negative relation where if one variable increases, the other decreases, and vice-versa.

No relation

0 denotes no linear relation. If two variables present 0, it means they share no relation. The changes in one variable have no impact on the other.

Note: The correlation coefficient does not explain the causation of the correlation.

Advantages and Disadvantages of the Correlation Coefficient in Finance

Correlation coefficients can be used for various purposes like science, finance, investments, etc. Along with advantages, the method also has several limitations.

The table below explains various advantages and disadvantages of the correlation coefficient: ³

Advantages of Pearson Coefficient

| Disadvantages of Pearson Coefficient

|

The correlation coefficient indicates the strength of the correlation between two variables

| The correlation coefficient method does not comment on the dependability of one variable on the other

|

By determining the covariance, the extent of correlation between two variables can be determined

| The method only explains the correlation strength and not the causation of the correlation

|

This method uses a scatter plot to represent the correlation. It is explained as positive, negative, or no relation with +1, -1, and 0, respectively

| In the correlation coefficient, there is no explanation of exactly what proportion of variation in the dependent variable affects the independent variable

|

Comparability is possible on different scales

| This method involves several assumptions like linearity between two variables, independence of each case, etc. ⁴ Assumptions may not always be true

|

In finance, correlation coefficients can help make informed decisions for investment, finance management, and more.

| The method of correlation coefficient is a time-consuming process. Also, the calculations have the probability of possible errors.

|

Additional Read: What is the Pearson Coefficient

Formula of Correlation Coefficient in Finance

Calculating the correlation coefficient requires the use of a formula. For decades, this formula has been in use. To begin with, you need to determine the standard deviation for two variables and the covariance between them. Here is the formula for calculating the correlation coefficient:

Here,

Pxy=Cov (x,y)

—–––––—

σx σy

ρ (xy) =Pearson product-moment correlation coefficient

Cov(x,y)=covariance of variables x and y

σ x=standard deviation of x

σ y =standard deviation of y

Covariance is used to determine if two variables are moving in the same direction or not. On the other hand, the correlation coefficient determines the strength of the correlation on a scale of -1 to +1.

How to Use Correlation Coefficient in Finance

Coefficient correlation is widely used in finances. There are several benefits of the method that businesses and investors can leverage. Let's discuss how the correlation coefficient can impact financial decisions:

Risk management

A perfect positive correlation, indicated by +1 means two variables move in the same direction. On the other hand, -1 means two variables move in opposite directions. So, when it comes to the risk management of a portfolio, a perfect positive may be risky. This is because if one investment goes into loss, the other may also go in the same direction. Hence, to balance the risk in a portfolio, investors usually opt for negatively correlated variables as well to ensure loss recovery and management.

Diversification of portfolio

Diversification of investment portfolios is a must. Pooling all your money in one or two stocks can be risky if the market movement goes against your investment. However, with a diverse portfolio, you can spread your investment into various stocks. This is when correlation coefficient methods can be helpful. Since it helps determine the strength of correlation of two variables, you can choose the best options for your portfolio.

Financial forecasting

Last but not least, correlation coefficients can also help in financial forecasting. It is a process of strategic and calculative predictions of future market trends. By understanding the correlation between different pairs of variables, guessing future probabilities can be possible. Based on these potential predictions, one can make various financial decisions. Businesses and investors largely leverage on forecasting!

Limitations of Correlation Coefficient

Correlation coefficients simply explain the extent or strength of correlation between two variables. It does not speak about the dependence of one variable on the other. That means using a scatter plot of the correlation coefficient, you cannot explain if variable A has any dependency on variable B. This is one of the biggest limitations of this method. Also, the slope of the scatter plot cannot be perfectly determined. Analysts use the least squares method for this purpose.

Data points or non-linear associations that are not within the scatter plot are not possible to understand. For this, non-parametric methods are used. So, these are some of the common limitations of using correlation coefficients. When coupled with other mathematical and statistical methods, correlation coefficients can be quite helpful in finances!

Conclusion

Understanding the strength of the correlation between two variables helps uncover various financial angles. For instance, you may understand the impact of marketing on sales of a product/service. Accordingly, you may manage the inventory and future sales. That's just one scope of this method. Businesses and investors have been leveraging this method for decades!