What is Nifty 50 and How to Invest in Nifty 50?

If you track financial news on a daily basis, you would have heard this term called “Nifty 50” several times by now. But, what is Nifty 50? It is an index comprising the 50 biggest large-cap companies in India. These companies are the leaders in their respective industries.

You can invest in Nifty 50 in two ways. First, you can check the weightage of various stocks comprising Nifty 50 and then you can invest in them exactly in the same weightage. Second, you can invest in an index fund that invests in Nifty 50. Such funds invest in stocks in the same percentage as they have in Nifty 50.

What is Nifty 50 in the Context of the Share Market?

Now that we know what Nifty 50 is, let us delve on other related aspects, like what its constituents are and how Nifty 50 works.

Additional Read: Trent and BEL to Join Nifty 50 Index, Divi's Lab and LTIMindtree Out

Key Features of Nifty 50

Source: https://www.niftyindices.com/Factsheet/ind_nifty50.pdf

Ø The stock must belong to an Indian company registered on the NSE.

Ø The stock must have high liquidity.

Ø The trading frequency of the company must be 100% in the last six months.

Ø The average free-float market cap of the company should be at least 1.5 times higher than that of the smallest company on Nifty 50.

Sector

| Weightage %

|

Financial Services

| 32.92

|

Information Technology (IT)

| 12.75

|

Oil, Gas & Consumable Fuels

| 11.25

|

Fast Moving Consumer Goods (FMCG)

| 8.58

|

Automobile and Auto Components

| 8.08

|

Telecommunication

| 3.95

|

Healthcare

| 3.92

|

Construction

| 3.73

|

Metals & Mining

| 3.64

|

Power

| 3.19

|

Consumer Durables

| 2.66

|

Construction Materials

| 2.06

|

Consumer Services

| 1.45

|

Services

| 0.92

|

Capital Goods

| 0.88

|

Source: https://www.niftyindices.com/Factsheet/ind_nifty50.pdf

How to Invest in Nifty 50?

Investing via Nifty 50 Index Funds

Those mutual funds that invest in the stocks that constitute Nifty 50 and in the same weightage as they have in Nifty 50 are called Nifty 50 Index Funds. Such funds are passively managed because the fund manager has to mirror the composition of Nifty 50. Hence, they have a lower expense ratio than actively managed funds.How to Invest in Nifty 50 through Exchange Traded Funds (ETFs)

You can also invest in a Nifty 50 ETF. Such funds are passively managed and they mirror Nifty 50 in terms of composition. Being an ETF, you can buy and sell units of Nifty 50 ETF throughout a trading day. However, the units of a mutual fund can be bought or sold only at the end of a trading day.Direct Investment in Nifty 50 Stocks

You can also directly invest in Nifty 50 stocks. By going to the NSE’s website, you can check the constituents of Nifty 50. After that, you can invest in these stocks on your own in the same percentage in which they constitute the Nifty 50 index. In this case, you will not have to pay anything to a manager of a mutual fund or an ETF. That said, you can also invest in Nifty 50 stocks in any percentage you desire.

Additional Read: What is Trading Account: Definition, Types & Benefits

NIFTY 50 Performance: How Much Return has it generated?

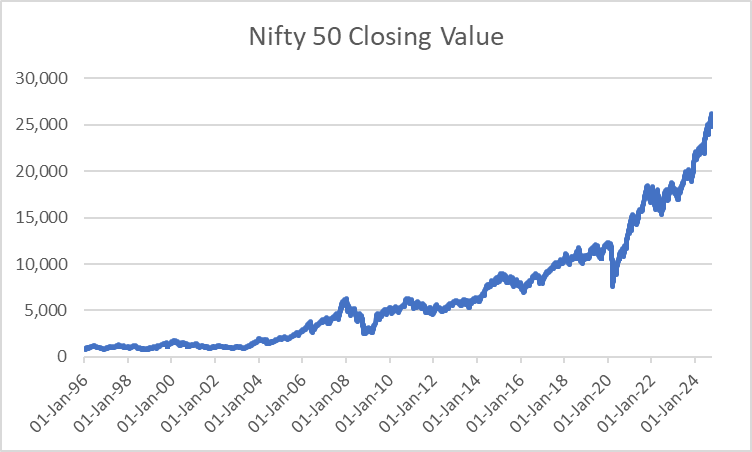

The graph below shows how Nifty 50 has performed since January 1, 1996. With the exception of a few dips, the index has mostly moved up in this time duration. If you had invested ₹1 in Nifty 50 on January 1, 1996, it would have become ₹27.5 by October 8, 2024. In other words, between January 1, 1996, and October 8, 2024, Nifty 50 has provided a compounded average annual return (CAGR) of 12.2%.