BAJAJ BROKING

🚨 Trading Holiday 🚨

Open a Free Demat Account

Trade Now, Pay Later with up to 4x

Track Market Movers Instantly

Gear Up for Budget 2025: Smart Pre-Budget Investment Ideas by Bajaj Broking

The stage is set for one of the most significant financial events of the year—the Union Budget 2025. Against the backdrop of slowing domestic growth and a challenging global environment, February 1 promises to bring policy updates that could influence key economic sectors.

To help investors navigate these changes, Bajaj Broking's Research Desk has conducted a comprehensive analysis. By focusing on sectors expected to gain attention and stocks showing strong fundamentals and technical resilience, we aim to provide valuable insights to guide informed investment decisions.

Major Wishlist from Budget 2025

Infrastructure Development:

A substantial increase in capital expenditure (capex) allocations is anticipated, focusing on roads, railways, and defence. Enhanced capex transfer to states through interest-free loans will further support regional development.

Balanced Welfare Spending:

While welfare spending as a percentage of GDP is expected to stabilize, greater emphasis on job creation and skill development is likely.

PLI Scheme Expansion:

An expansion of the Production-Linked Incentive (PLI) scheme to include additional sectors is expected. This move will promote domestic manufacturing and reduce reliance on imports, fostering a robust industrial base.

Tax Simplification for Investors:

Expectations are high for further rationalization of long-term capital gains tax and reduced Securities Transaction Tax (STT) to encourage market liquidity.

Key Changes Expected in Budget 2025

1. Banking and NBFCs:

Banking Sector: No major tax adjustments for banks, but selective public sector banks and insurers may receive capital infusion.

NBFCs: A reduction in the loan limit under the SARFAESI Act from ₹2 million to ₹1 million is anticipated. Additionally, new credit guarantee schemes for microfinance institutions may be introduced.

2. Auto Sector:

The auto sector could benefit from allocations under the PM E-Drive and Auto PLI policies. These measures are expected to encourage the localization of EV components. Tax breaks for rural schemes and enhanced housing-related incentives could further support growth in the sector.

3. Healthcare and Pharma:

Enhanced funding for research and development, especially in critical areas such as anti-diabetic and weight-loss medications, is expected. Increased allocations to Ayushman Bharat and AIIMS are also on the cards.

4. Consumer Sector:

While cigarette taxes may rise marginally, higher allocations to PM Awas Yojana and other consumption-driven schemes are expected to boost the consumer sector. However, a rollback of the increased customs duty on gold is unlikely.

5. Oil and Gas:

Compensation for LPG under-recoveries is anticipated, particularly after no relief was provided in FY24. Indian Oil Corporation Limited (IOCL) is likely to be a key beneficiary.

6. Infrastructure and Defence

Infrastructure: Higher allocations for large-scale projects like Dedicated Freight Corridors and highways are expected to drive development.

Defence: Focus on enhancing domestic procurement and boosting defence exports.

Stock Recommendations from Bajaj Broking Research Desk

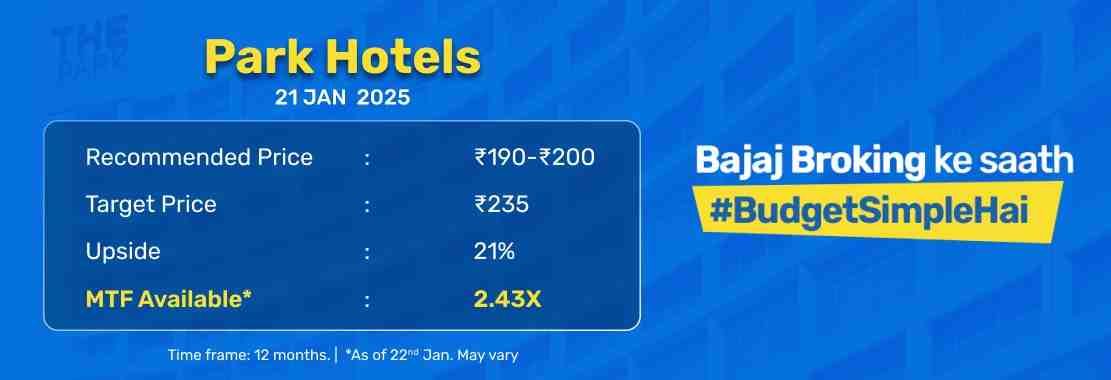

Apeejay Surrendra Park Hotels Ltd

Buying Range: ₹190-₹200, Target Price: ₹235, Upside: 21%, Time Horizon: 12 Months

About the Company: Apeejay Surrendra Park Hotels operates 34 properties across India with a focus on upscale and upper mid-scale hospitality. It also has a strong presence in the food and beverage (F&B) segment through its brand Flurys, known for its asset-light and scalable model.

Why Invest: The stock is poised for a breakout, backed by strong operational performance and ambitious expansion plans. Flurys aims to grow its store count significantly, targeting 120 stores by FY25.

DCX Systems Ltd

Buying Range: ₹355-₹380, Target Price: ₹449, Upside: 24%, Time Horizon: 12 Months

About the Company: DCX Systems is a leading player in the defence and aerospace industry, providing end-to-end solutions such as cable and wire harnesses, electronic sub-systems, and high-end system integration.

Why Invest: The stock is on the cusp of a breakout after 14 months of consolidation. It has a robust order book exceeding ₹30,000 million, including contracts with global giants like Lockheed Martin and ELTA Systems

Ion Exchange (India) Ltd

Buying Range: ₹615-₹670, Target Price: ₹780, Upside: 23%, Time Horizon: 12 Months

About the Company: Ion Exchange provides sustainable water treatment solutions across the entire water cycle, including zero liquid discharge and seawater desalination. The company’s divisions include engineering, chemicals, and consumer products.

Why Invest: Ion Exchange has demonstrated consistent growth in revenues and profitability. Its focus on optimizing capacity utilization and product mix supports long-term sustainability. The company’s order book at the end of Q2 FY25 stood at ₹35,800 million.

Conclusion

Budget 2025 promises to be a transformative event for India’s economy, balancing fiscal prudence with growth-oriented initiatives. With strategic investments in key sectors and potential tax reforms, investors have much to look forward to.

You can check out the detailed report by Bajaj Broking Research Desk by clicking on the button below. Stay tuned for more insights and updates on Budget 2025 because Bajaj Broking ke saath #BudgetSimpleHai.

Do you have a trading account app or demat account app?

You can open an account with Bajaj Broking in minutes.

Download the Bajaj Broking app now from Play Store or App Store.

Disclaimer: Investments in the securities market are subject to market risk, read all related documents carefully before investing.

This content is for educational purposes only. Securities quoted are exemplary and not recommendatory.

For All Disclaimers Click Here: https://bit.ly/3Tcsfuc

Share this article:

Read More Blogs

Our Secure Trading Platforms

Level up your stock market experience: Download the Bajaj Broking App for effortless investing and trading